The federal carbon tax accounts for roughly 25 percent of the heating bill

The federal carbon tax is an environmental policy that the Canadian government has implemented to reduce greenhouse gas emissions since 2019. This tax is applied to the consumption of fossil fuels such as gasoline, natural gas and coal.

The impact of the carbon tax on the heating bill:

Price hikes: A carbon tax raises the price of fossil fuels, including natural gas, which is used to heat many homes.

Increase: On average, the federal carbon tax adds about 25 percent to your heating bill.

Regional differences: Price increases vary across Canada. In general, the price increase will be higher in colder areas that are more dependent on heating.

Cost reduction solutions:

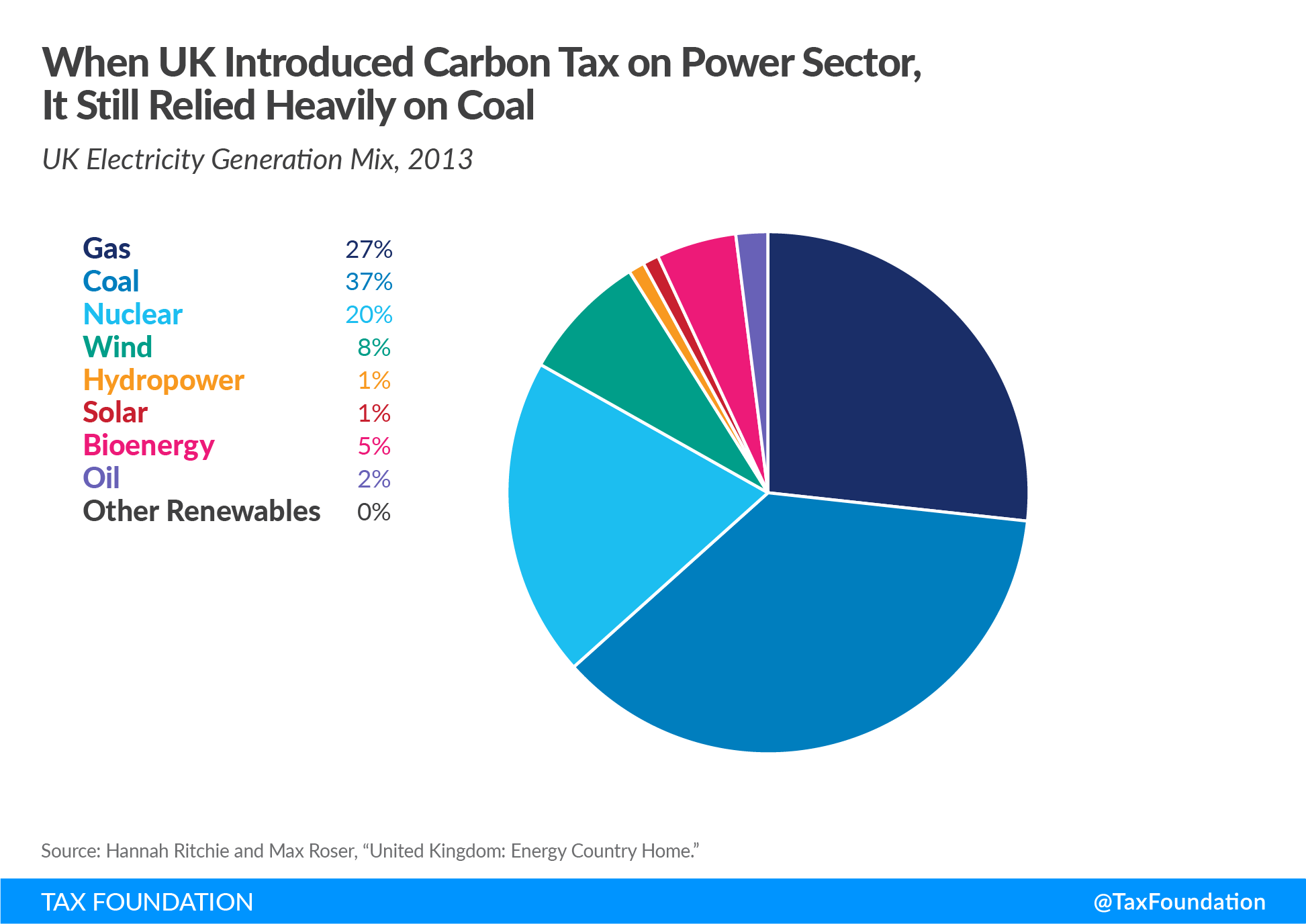

Use of renewable energy sources: The use of renewable energy sources such as heat pumps and solar panels can help reduce dependence on fossil fuels and, consequently, reduce heating costs.

Increase energy efficiency: By increasing the energy efficiency of the house, you can reduce fuel consumption and heating costs.

Use financial assistance programs: The Government of Canada offers financial assistance programs to help households pay their carbon tax.

considerations:

Social justice: Some critics argue that a carbon tax could put more financial pressure on low-income households.

Economic impact: There are some concerns about the impact of a carbon tax on jobs and the economy.

Conclusion:

A federal carbon tax can add up to 25 percent to your heating bill. There are ways to reduce this cost, such as using renewable energy sources, increasing energy efficiency, and using financial assistance programs.

news source

Suggested Content

Latest Blog

Login first to rate.

Express your opinion

Login first to submit a comment.

No comments yet.